Can A Debtor Refuse Plan Uk by Debt Collection Agency Oldham

When you have paid your debt following your original agreement, and they now are increasing the amount after you paid in full, Debt Collection Agency Oldham strongly suggest seeking help from the consumer financial protection bureau. The consumer financial protection bureau listen to complaints for debt collection practices and are well equipt in providing you the best solution for your circumstance. If you are in need of help then do not hesistate to contact the consumer financial protection bureau, where you can file a complaint against unfair debtors.

Fair Debt Collection Practices From Debt Collection Agency Oldham

The collector is able to try and collect the debt from you if they follow the guidelines of the fair debt collection practices act, Debt Collection Agency Oldham are here to answer futher questions on this matter. Under the fair debt collection practices act, debtors cannot threaten to take you to court if they have no intention on follow through with the threat.

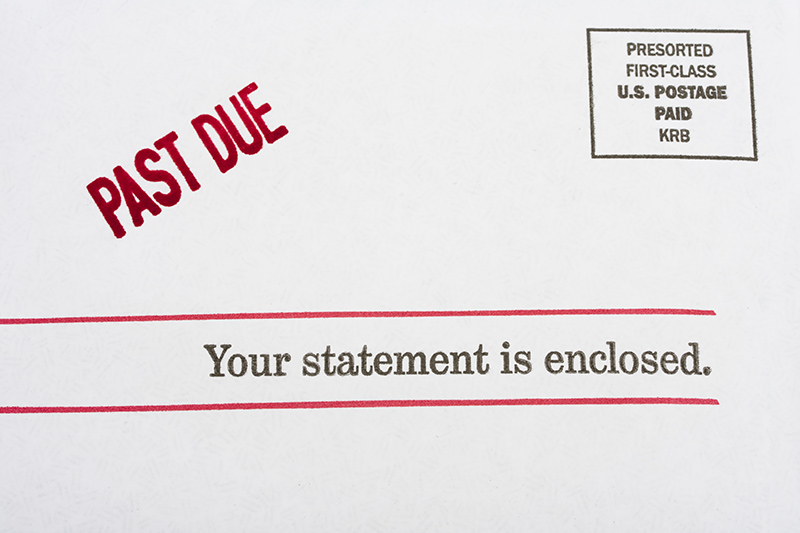

A debt collection agency can only begin to deal with your debt if it has been owed for a long period of time. When a debt collection agency get into corospondance with you, you should contact Debt Collection Agency Oldham ASAP as they can help you to work out a budget and get back on track with your finances. The only corrospondance should be between you and your debt collection agency in regards to your debt, no one else has a right to know. You have the right to file a complaint, when you believe you have been treated unfairly by baillifts, to the FCA and the debt collection agency that you are dealing with.

Oldham, Greater Manchester Consumer Law Attorney

Contact a Oldham, Greater Manchester consumer law attorney if you are in need of advice concering your buisness debt. A consumer law attorney who specilises in credit damage and debt collection cases are able to offer you a professional consultation in Oldham, Greater Manchester.

There are many debt collection agencies opporating across the uk who all specilise in the different neches of debt collection. There are many different tatics that a debt collection agency will use and they may try and force you into repaying your debt in one big payment, however, you are able to set up a playment plan with them to make your life easier. When regarding your council tax, debts and debt collection agencies you have legal rights, therefore, it is imporatnt to remember this when dealing with debt collection agencies.

Do You Need Help ?

Call Us Now On

Debt Management In Oldham

Debt Collection Agency Oldham, Oldham advice that you keep your choosen debt management company updated with any payments and who you are woorking with, such as a payplan. Dependant on how much you owe to who, you may want to use a debt management plan or another payment arrangement, that offers you the chance to repay your debt in reasonable monthly installments, talk to Oldham, Debt Collection Agency Oldham for more information. An alternative in Oldham and the rest of the UK is actually calling a credit counselor who can give advice and help the claimant strive towards a realistic debt management plan.